Start your application for this job today

Apply NowLoans Asset Manager in Manchester

Loan Asset Manager - Commercial Real Estate (Italian/French Speakers) RussellTobin is currently seeking a Italian/French speaking Loan Asset Manager whose primary responsibility is supporting the management of client growing EMEA 3rd party Loan portfolio of commercial real estate loans. The candidate is responsible for the monitoring, servicing and accounting of the loan portfolio. The position is expected to periodically provide inputs for budgets, cost recovery, income, business and operating issues, along with recommendations. Location: Manchester (Hybrid) Duration – Permanent KEY RESPONSIBILITIES -

- Manages assigned commercial real estate loans in the UK and continental Europe and monitors their performance.

- Monitors the performance of properties securing the loans and their ability to support loan payments.

- Prepares CMSA and other reports with respect to the loans.

- Performs research involving loan documents and servicing agreements.

- Evaluates and prepares recommendations for lender consent items on loan and real estate related issues.

- Responsible for the set-up of new loans in loan servicing system and maintains the integrity of loan information.

- Manages loan document files and document imaging.

- Monitors loan document compliance by borrowers, including maintenance of property insurance and submission of rent rolls and property operating statements.

- Prepares operating statement analyses, other collateral review activities.

- Special projects as required.

SKILLS REQUIRED -

- Proven experience in the UK & European real estate finance sector.

- Italian or French Speakers

- Experience of executing real estate debt transactions within the UK & Europe for a broad range of transactions (across various asset classes as well as investment and development loans).

- Debt due diligence and transaction management expertise.

- Execution and documentation experience.

- Experience of structuring and negotiation of transaction terms.

- Excellent analytical skills, both commercial and financial, including an advanced knowledge of financial modelling techniques.

- Ability to run your own analysis / models for transactions.

- Strong credit analysis skills and ability to present transactions to credit committees.

- Business development skills: borrower contacts and personal network to support loan origination.

- The ability to prepare and present financing proposals with the skill and experience to influence and overcome objections.

- Able to lead the completion of any financing including legal documentation.

Education/Experience:

- Educated to degree level or equivalent with a minimum of two years relevant experience; or equivalent combination of education and experience.

If interested please CLICK ON APPLY and we will get back to you within 24 hours!!!!

Rate/Salary: 60000

Related jobs near me

People also searched for

About Manchester, Greater Manchester

Education Stats

- Schools: 438

- Primary Schools: 295

- Secondary Schools: 100

- Sixth Forms: 26

- 12% are independent

- Ranking: 817/4558

- Top 20%

House Prices

- Average House Price: £296,455

- Compared to UK Average: -£78,188

- -

- -

- -

- Ranking: 4300/6610

- Bottom 20%

- Council Tax Band D: £1,970

Average Salary

- Average Salary: £36,454

- +£3,812 UK Average

- Average Salary in Greater Manchester: £33,475

- -

- -

- Ranking: 4798/4982

- Top 20%

- Highest Paid Job Advertised: Head of Finance

Crime Stats

- Crimes per 1000: 0

- -

- -

- -

- -

- Ranking: 200/6696

- Safest 20%

- Worse than last year

The best places to find the most Loans Asset Manager jobs

Companies:

Recruitment Agencies:

Job Boards:

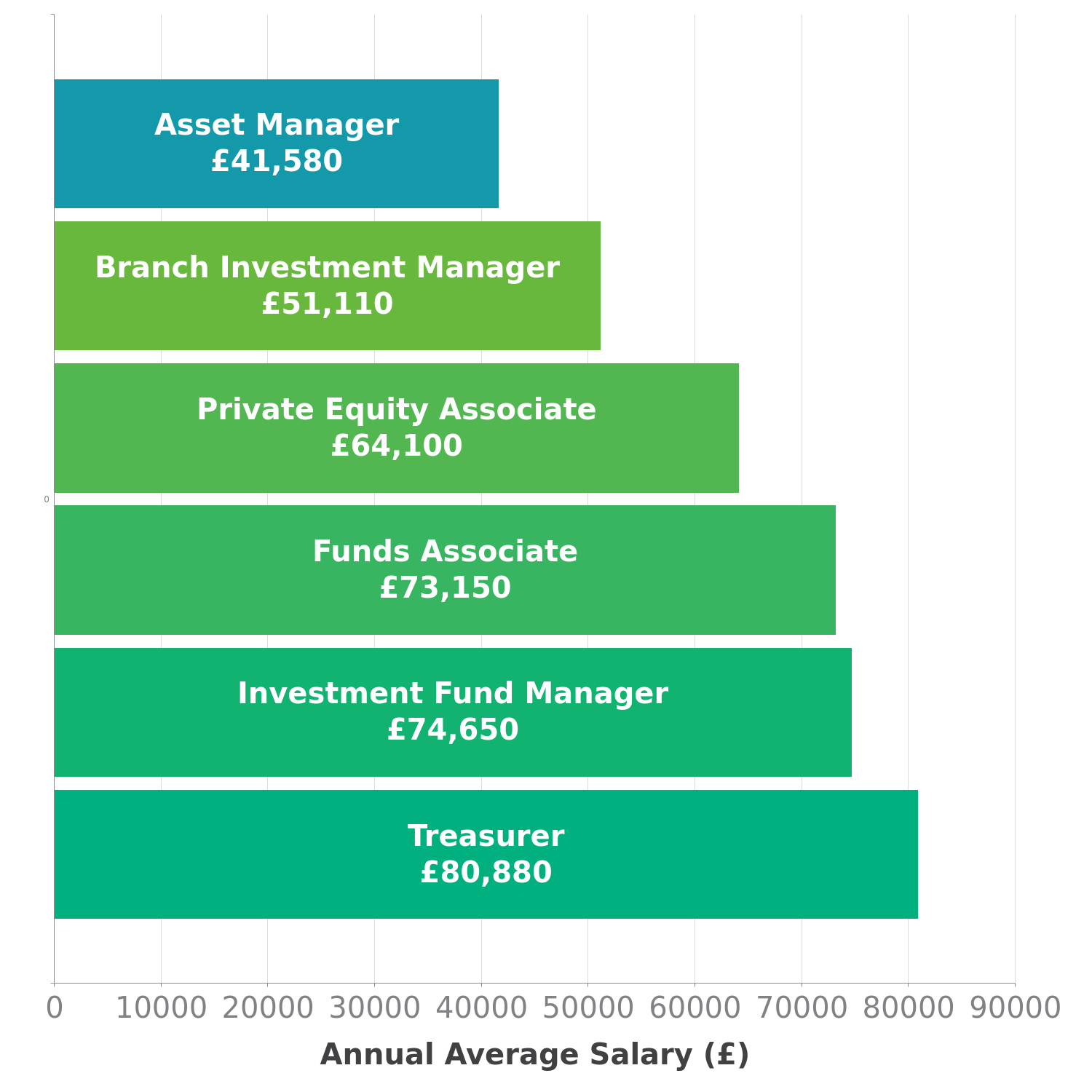

Average salary comparison

Job salary over time

Salaries by job level

Salary across the UK

Useful Resources:

Career Advice:

CV template for a Loans Asset Manager

View Now