Start your application for this job today

Apply NowAssociate Director in London

Cynergy Bank was established in 2018 by entrepreneurs to serve the needs of business owners, property entrepreneurs and family businesses. We have a strong track record supporting businesses that want to scale up and provide over £3bn lending to scaling businesses across the UK, we also offer retail deposits to UK savers. Our vision is to provide a truly personalised service that is delivered through face-to-face relationships and enhanced by the latest technology.

Application Deadline: Friday 28th June 2024

Hybrid Working Pattern - 3 days in Office & 2 WFH

About us

Cynergy Bank is the UK’s human digital bank serving the needs of ‘scale up’ or medium sized and fast-growing SMEs; professionals; high net worth and mass affluent individuals, in essence those market segments that still value human service enabled by great technology.

We recognise that professional and personal lives often overlap and our mission is to help empower our customers to achieve their ambitions by serving all their interdependent banking needs. We provide a comprehensive range of digitally enabled products and services to meet the property finance, business and commercial banking, private banking and personal savings needs of our customers.

Our human and digital model transforms banking for customers who still value a face-to-face relationship that is enabled by the latest digital technology.

We partner with firms such as Google Cloud, Cigniti and Slalom as we continue to innovate in the human digital space.

Cynergy Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Eligible deposits with Cynergy Bank Limited are protected by the UK Financial Services Compensation Scheme .

For more information on Cynergy Bank visit

Company Benefits

- Competitive Salary and Company Bonus

- 210 hours (30 days) holiday plus bank holidays

- Option to purchase an additional 10 days holiday

- Pension contribution and Life Assurance

- Income Protection Scheme and Season Ticket Loan

- Private Medical Insurance and Health Check (After Probation)

- Electric Car Scheme and Money Coach (After Probation)

The role

An opportunity has arisen in the Development Finance team to support frontline deal origination activities. Previous experience of lending in this sector is desired as well as a strong work ethic and enthusiasm to support new business activities.

Responsibilities:

- Support development finance team to ensure achievement of overall growth and income targets and adherence to bank standards in respect of credit, operational and regulatory risk

- Prepare and submit credit applications for development finance facilities, ensuring appropriate commentary and analysis to aid decision making

- Proactively manage all transactions from credit assessment through to completion alongside Transaction Execution Manager including preparation of Heads of Terms, follow valuation and account opening processes

- Support management team in the ongoing management and review of customer facilities

- Obtain relevant information in respect of further drawdowns including monitoring reports and arrange for further drawdowns subject to all conditions being met in line with the Bank’s policies / procedures

- Maintain delivery of a high quality service to customers, liaising as appropriate with other parts of the business to ensure needs are met

- Ensure that KYC procedures including the requirements for periodic reviews in accordance with the AML framework on all customer connections are maintained and recorded

- Develop an understanding of the Bank’s products and services. Identify and introduce sales opportunities.

Essential Knowledge & Experience

- Technical skills:

- Experience in a similar role;

- Development finance appraisal knowledge;

- Credit analysis;

- Financial analysis and cashflow modelling; and

- Credit writing.

- Soft skills

- New deal origination and network building;

- Stakeholder engagement; and

- Relationship management.

- Risk and/or governance responsibilities

- AML/ KYC experience; and

- Credit risk monitoring and reporting.

Related jobs near me

People also searched for

About London,

Education Stats

- Schools: 5659

- Primary Schools: 3557

- Secondary Schools: 1393

- Sixth Forms: 795

- 17% are independent

- Ranking: 1/9

- Top 20%

House Prices

- Average House Price: £773,961

- Compared to UK Average: +£399,319

- -

- -

- -

- Ranking: 1/9

- Top 20%

- -

Average Salary

- Average Salary: £40,701

- +£8,060 UK Average

- -

- -

- -

- Ranking: 9/9

- Top 20%

- Highest Paid Job Advertised: Quantitative Analyst

Crime Stats

- Crimes per 1000: 121

- -

- -

- -

- -

- Ranking: 7/9

- Bottom 40%

- Worse than last year

The best places to find the most Associate Director jobs

Recruitment Agencies:

Job Boards:

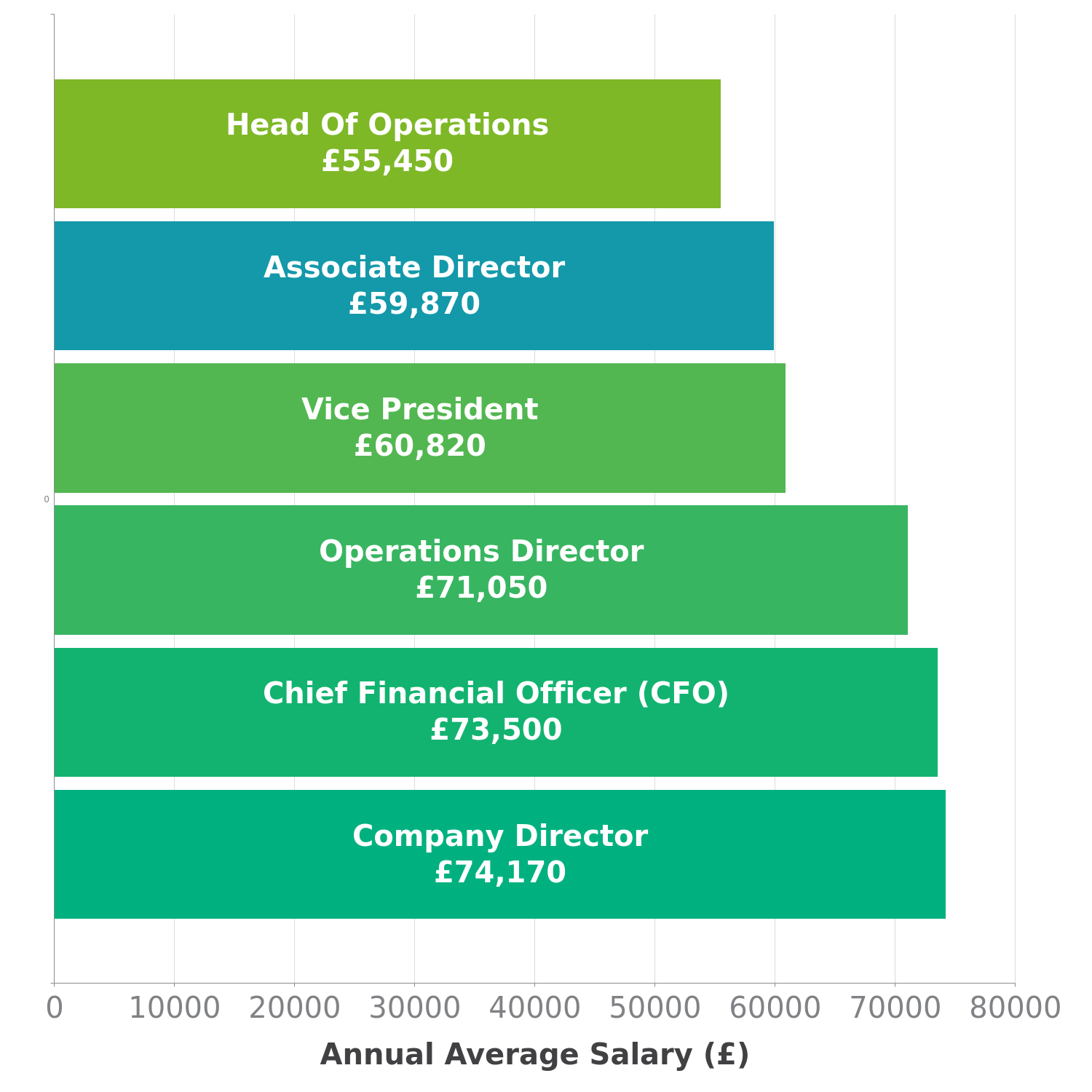

Average salary comparison

Job salary over time

Salaries by job level

Salary across the UK

Useful Resources:

Career Advice:

CV template for a Associate Director

View Now